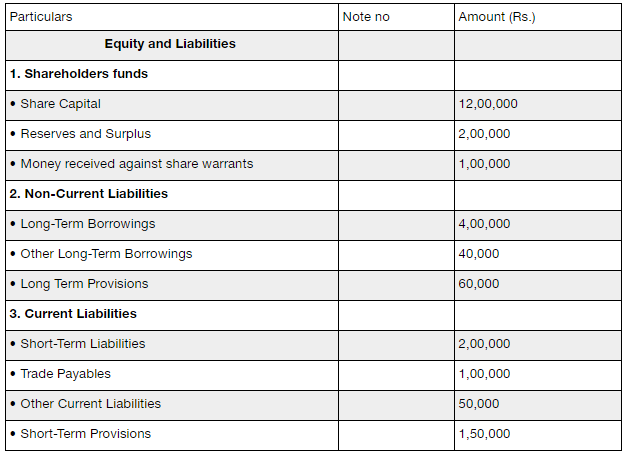

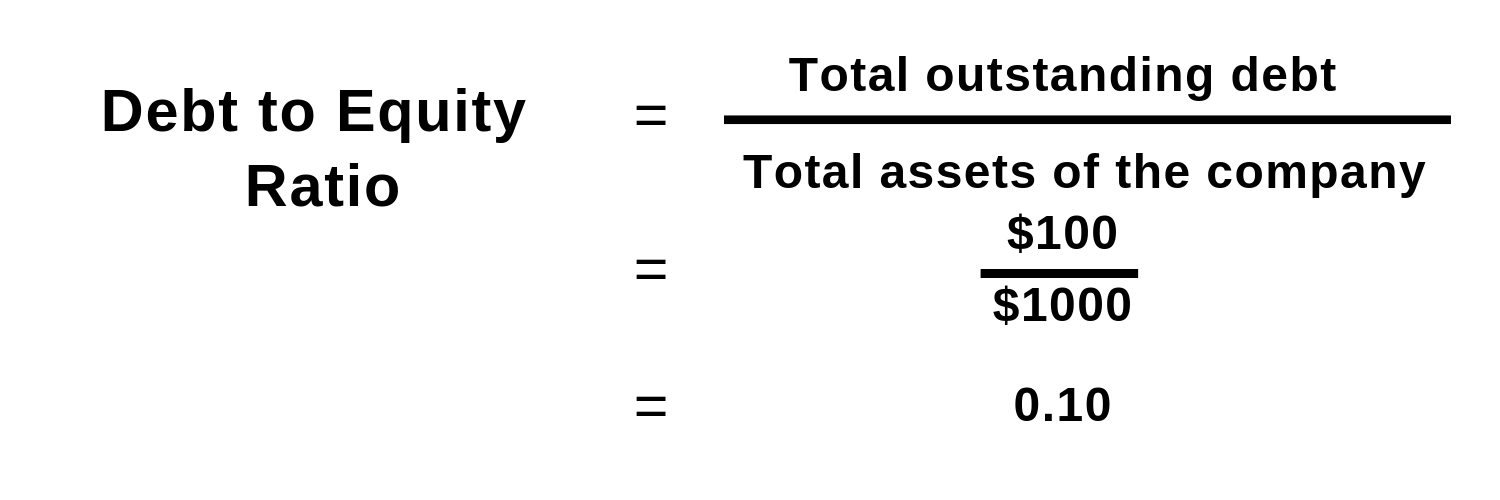

The debt/equity ratio, also known as the financial leverage ratio or D/E ratio, is a financial metric that measures the proportion of a company’s total debt to its shareholders’ equity. It provides insights into the company’s capital structure and indicates the extent to which it relies on debt financing compared to equity financing. Debt ratio is a metric that measures a company’s total debt, as a percentage of its total assets.

Do you own a business?

A company with a D/E ratio that exceeds its industry average might be unappealing to lenders or investors turned off by the risk. As well, companies with D/E ratios lower than their industry average might be seen as favorable to lenders and investors. The ideal debt/equity ratio varies across industries and depends on the company’s business model and financial goals. Generally, a D/E ratio below 1 is often considered conservative and indicates that the company relies more on equity financing. A ratio around 1 suggests a balanced capital structure, while a ratio above 1 may signal higher financial risk due to greater reliance on debt.

- Coryanne Hicks is an investing and personal finance journalist specializing in women and millennial investors.

- In general, a lower D/E ratio is preferred as it indicates less debt on a company’s balance sheet.

- Again, context is everything and the D/E ratio is only one indicator of a company’s health.

- Acceptable levels of the total debt service ratio range from the mid-30s to the low-40s in percentage terms.

Great! The Financial Professional Will Get Back To You Soon.

The debt-to-equity (D/E) ratio can help investors identify highly leveraged companies that may pose risks during business downturns. Investors can compare a company’s D/E ratio with the average for its industry and those of competitors to gain a sense of a company’s reliance on debt. A company can reduce its D/E ratio by paying off existing debt, avoiding excessive new debt issuance, and increasing equity through retained earnings or equity financing.

Related Terms

He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. Investors may check it quarterly in line with financial reporting, while business owners might track it more regularly. Currency fluctuations can affect the ratio for companies operating in multiple countries. It’s advisable to consider currency-adjusted figures for a more accurate assessment. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

The principal payment and interest expense are also fixed and known, supposing that the loan is paid back at a consistent rate. It enables accurate forecasting, what is pr payment what is pr payment by hatellove6294 which allows easier budgeting and financial planning. If a D/E ratio becomes negative, a company may have no choice but to file for bankruptcy.

Current Ratio

This is because the industry is capital-intensive, requiring a lot of debt financing to run. Restoration Hardware’s cash flow from operating activities has consistently grown over the past three years, suggesting the debt is being put to work and is driving results. Additionally, the growing cash flow indicates that the company will be able to service its debt level.

Conversely, a debt level of 40% may be easily manageable for a company in a sector such as utilities, where cash flows are stable and higher debt ratios are the norm. The D/E ratio is a financial metric that measures the proportion of a company’s debt relative to its shareholder equity. The ratio offers insights into the company’s debt level, indicating whether it uses more debt or equity to run its operations. The Debt to Equity Ratio (D/E) measures a company’s financial risk by comparing its total outstanding debt obligations to the value of its shareholders’ equity account.

Lack of performance might also be the reason why the company is seeking out extra debt financing. If a company has a negative debt ratio, this would mean that the company has negative shareholder equity. In most cases, this is considered a very risky sign, indicating that the company may be at risk of bankruptcy. It’s great to compare debt ratios across companies; however, capital intensity and debt needs vary widely across sectors. The financial health of a firm may not be accurately represented by comparing debt ratios across industries.