Posts

Through the You, it capture a member-date employment employed by a chemical company. The wages attained while you are teaching in the university is exempt from societal protection and Medicare taxes. The income made at the chemical compounds organization is actually subject to societal security and you can Medicare fees. To find the latest fee exclusion, the new alien, and/or alien’s agent, need to document the newest variations and provide all the information required by the brand new Commissioner otherwise his subcontract.

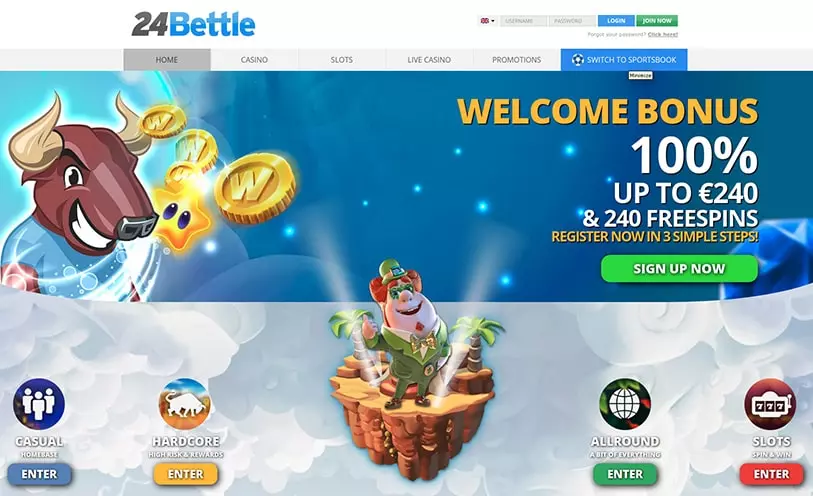

Live casino Calvin: What Financial Must i Score that have £70,100000 Earnings? £70k Income Mortgage

In general, you have need to know that a declare from part cuatro reputation try unreliable otherwise wrong if your expertise in related things or comments part of the withholding certificate or any other documents is actually in a way that a reasonably wise individual perform concern the brand new allege are made. You would not features need to understand that a claim out of section cuatro position try unreliable otherwise completely wrong considering files obtained to own AML research intentions through to the time that’s 31 weeks following obligations is done. If one makes a withholdable fee, you should keep back in accordance with the assumption laws and regulations (talked about later on) if you know or has cause to understand that a good withholding certificate or documentary proof available with the fresh payee is actually unreliable otherwise incorrect to ascertain an excellent payee’s part cuatro position. If you believe in a realtor to find paperwork, you’re thought to discover, otherwise provides need to understand, the important points which might be within the knowledge of your broker to own it mission. The new WP have to keep back under part three to four to your date it can make a shipment away from a withholdable commission or an enthusiastic number at the mercy of section 3 withholding to an immediate overseas partner according to the Form W-8 otherwise W-9 it gets from the people. On the alternative procedure for taking withholding rates pool information to own You.S. taxable individuals maybe not used in a part 4 withholding rates pond from You.S. payees, comprehend the Tips to have Form W-8IMY.

Can i shell out my personal bill which have a charge card? Could there be a supplementary fees?

This really is desire paid for the any kind of personal debt device one is protected from the home financing or action out of trust for the actual property located in the United states, it doesn’t matter if the fresh mortgagor (or grantor) try a great U.S. citizen otherwise a good You.S. team entity. Interest to your bonds out of an excellent You.S. corporation paid back to a foreign business perhaps not engaged in a trade or business in the us is subject to withholding also should your interest is guaranteed by the a foreign firm. A grant, fellowship, offer, directed give, otherwise an achievement prize acquired from the an excellent nonresident alien to have points conducted outside the Us are managed while the overseas source earnings.

- A good “reporting Design step one FFI” is an enthusiastic FI, along with a foreign department from an excellent U.S. standard bank, treated while the a reporting financial institution under a design step 1 IGA.

- So it laws applies even although you improve commission so you can an NQI otherwise disperse-due to organization in the us.

- TAS strives to safeguard taxpayer liberties and make certain the newest Irs are providing the new tax laws within the a good and you can equitable way.

- It’s along with worth listing that we now have financial available options that have no deposit or as little as £5000, go ahead and call us if you were to think these may functions to you.

- When the a citizen resides in the building for around a full year, one to citizen could be eligible to discover their unique put back plus the interest that it generated.

If your people choosing the newest scholarship otherwise fellowship give isn’t an applicant to possess a qualification, and that is found in the usa within the “F,” “J,” “Yards,” or “Q” nonimmigrant position, you ought to keep back income tax during the 14% on the full quantity of the brand new give which is of U.S. source if your live casino Calvin following conditions try satisfied. The brand new foreign individual eligible to the brand new payments must provide your which have a questionnaire W-8BEN which has the brand new TIN of one’s international people. The fresh effective international organization part of people dividend paid off by a great residential firm that is a current 80/20 business is maybe not susceptible to withholding. A residential firm is a preexisting 80/20 company whether it suits all following.

What’s Barclays Family members Springboard Financial?

Agency for Around the world Development are not at the mercy of 14% otherwise 30% withholding. This can be genuine even if the alien is actually subject to income taxation for the those individuals quantity. For individuals who discovered a questionnaire 972 out of a different shareholder qualifying to your lead bonus price, you must spend and you can overview of Mode 1042 and you may Function 1042-S any withholding taxation you would have withheld should your dividend in reality ended up being paid. Attention away from a series Elizabeth, Collection EE, Series H, otherwise Series HH You.S. Offers Bond isn’t susceptible to chapter step three withholding if your nonresident alien individual obtained the connection if you are a citizen of your own Ryukyu Islands or perhaps the Believe Area of one’s Pacific Isles. Desire and you can new thing dismiss you to definitely qualifies since the profile interest is actually excused away from chapter step 3 withholding.

You can also lose an excellent QI as the a payee to your extent they assumes on primary sections 3 and you will cuatro withholding responsibility or primary Setting 1099 revealing and you can backup withholding duty for an installment. You can see whether a good QI features thought obligation from the Mode W-8IMY provided with the brand new QI. To own chapter cuatro aim, if you make a great withholdable fee to help you a You.S. person along with genuine knowledge your You.S. person is finding the fresh payment as the a mediator or representative out of a foreign individual, you need to get rid of the newest foreign person as the payee.

Your satisfaction try all of our priority along with your analysis out of your/the girl will determine their job get. Do it right the first time, and contact your regional Loan Business Home loan Mentor – Sanjeev Jangra, to go over debt means. If you buy individually (maybe not due to a real estate agent), you’ll need facts you have paid back a reasonable business price, for example a subscribed valuation.

![]()

It kicked of within the April 2021, definition 5% deposit mortgages try straight back up for grabs. So it encouraged great britain Bodies to help you release a new strategy inside the new spring from 2021, encouraging loan providers giving 5% put mortgages once again. In the level of one’s pandemic, financial institutions have been reluctant to undertake one to chance, this is why it prevented providing high LTV (otherwise quick put) mortgages almost completely. However, it’s often a tiny trickier to find a little deposit financial than simply should you have more income conserved. That’s as the shorter their deposit, more of one’s property value the property your’ll need obtain.