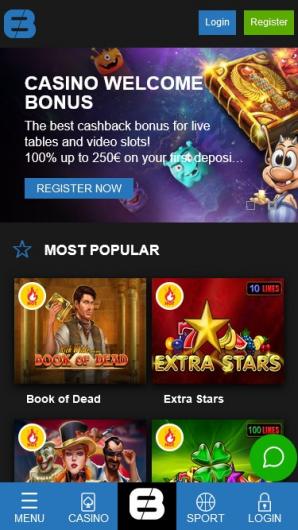

Very online casinos features the very least put from either $10 or $20, that is still a good restrict, even if you’re on a budget. All these providers give great bonuses, very please speak about them via all of casino gday uk our system. Considering a great 5 dollars lowest put gambling enterprise Canada deal benefits, online casino brands admit the brand new benefits’ importance to spur users to join up and you may put. Such perks, for instance the invited put bonus and related also provides, can also be rather effect players’ effect. Our evaluation from on line a real income casinos prioritizes certification, since it’s a crucial signal from a website’s validity and you will precision. We come across casinos which can be prior to Canadian laws and regulations and you may are accountable to the correct regulatory regulators per region.

Available to people away from AL, AR, Fl, GA, IL, Inside, IA, KY, La, MS, MO, NC, Sc, TN, and you may Colorado. Accessible to owners out of NH, MA, RI, CT, DE, Ny, Nj-new jersey, PA, otherwise Fl. Readily available for residents from IA, IL, Inside, KS, MI, MN, MO, OH otherwise WI. See the costs on each of them accounts while they often will vary.

There are numerous the new methods to the safety put situation—certain was lauded because of the sensible housing advocates, while others had been confronted with skepticism and you can distrust—tend to with good reason. Everything’ll have to be cautious about is the month-to-month non-refundable percentage you can even end up using. These charge just go on the improving the possessions pay the insurance policies therefore however can be charged money on circulate-away for injuries.

You can prove that you has a better link with a few foreign places (but not more a couple of) if you meet all the following criteria. A professional runner who is briefly in the us to help you vie inside the a non-profit sports enjoy is actually an exempt personal. A charitable football experience is just one that suits another requirements. You would not be an exempt individual while the an instructor or trainee within the 2024 if you were exempt while the an instructor, trainee, or scholar for part of 2 of the 6 preceding schedule many years. Yet not, you’re an exempt personal when the all the following the criteria are came across.

Line step one – Interest money: casino gday uk

Because of the San francisco’s infamously air-large housing will cost you, plus the part’s homelessness crisis, it’s unsurprising that the need for assistance with deposits regarding the area much outstrips the production. The fresh Homes Trust away from Silicon Area, a bay area people development standard bank, features a grant program specifically for enabling someone experiencing homelessness in the the space manage defense places. The new Eventually Home Put System is actually financed from the Applied Material Silicone polymer Area Turkey Trot, an annual 5K one pulls specific 10,000 to help you 15,100 runners. Houses Believe spends their portion of the fund to prize one-day has as high as $2,five hundred from the put program to help individuals log off homelessness by level upfront swinging costs. And though deposits try by definition refundable, there’s no ensure clients gets those funds straight back, whether or not they shell out their book and you may remove the device really.

So it just has transportation income which is addressed since the based on offer in the united states in case your transportation initiate otherwise comes to an end in the usa. To have transport income out of personal functions, the new transport have to be involving the United states and a great U.S. territory. For personal characteristics out of an excellent nonresident alien, which only applies to income derived from, or perhaps in experience of, an airplane. Although not, if there is a primary monetary relationship involving the carrying of the fresh asset plus change or business to do individual features, the cash, acquire, or losses try effectively connected.

Calculating Their Tax

When you are a worker and you discover wages subject to U.S. income tax withholding, you are going to basically file by fifteenth day’s the new last day immediately after the income tax year ends. To the 2024 season, document your own return by the April 15, 2025. You should document Mode 1040-NR when you are a twin-position taxpayer just who gets up household in the us throughout the the season and who isn’t a great You.S. citizen to your last day’s the brand new taxation 12 months.

- If you are a resident of Mexico or Canada, otherwise a nationwide of the You, you could allege each of your dependents just who match certain screening.

- The choice to become handled because the a citizen alien is frozen the income tax year (following the income tax seasons you have made the possibility) if the neither partner are a great You.S. resident or resident alien at any time within the taxation 12 months.

- For many who be eligible for which election, you possibly can make they by the processing a questionnaire 1040 and you can attaching a signed election statement to the return.

- This informative guide breaks down popular items clients face and you may explains exactly how various other condition regulations manage tenants as if you.

- You need to document Form 8938 if the complete worth of those individuals assets exceeds an appropriate tolerance (the fresh “revealing endurance”).

In addition, it have an excellent 35x wager conditions, making it easier to possess players in order to meet the newest requirements and you may cash-away its earnings alternatively problems. The fresh Harbors Local casino embraces The newest Zealand participants which have an astounding bonus bundle up to NZ$the first step,five-hundred with just an excellent NZ$5 deposit. In case your investment gains and you may dividends try efficiently linked to an excellent U.S. exchange otherwise team, he is taxed depending on the exact same legislation as well as the newest exact same prices you to definitely affect You.S. citizens and you will owners. When you are a great You.S. resident or resident and you love to eliminate your own nonresident mate as the a citizen and you can file a mutual income tax get back, your own nonresident partner means a keen SSN or a keen ITIN. Alien partners that are claimed as the dependents also are needed to present a keen SSN otherwise ITIN. If you aren’t a member of staff just who gets wages subject to You.S. income tax withholding, you must document from the 15th day of the brand new 6th month immediately after your own taxation season comes to an end.

If a property manager does not shell out the resident interest, they can be fined around $a hundred for each and every offense. Although not, possessions professionals need not shell out residents desire for month if the citizen is actually 10 or higher days late paying book and you may was not recharged a late percentage. While the a property owner inside Connecticut, getting better-advised about the current protection put laws isn’t only sound practice—it’s a cornerstone of your company’s credibility and you will legal compliance.

You.S. Bank accounts to have Canadians

A handful of says enable it to be landlords to help you costs a lot more, but close characteristics’ field price usually is out there. When you’re part of an excellent HUD rental direction system, your defense deposit is generally as little as $fifty. For the majority of, getting security deposits right back isn’t just an excellent “sweet topic” that occurs otherwise some “enjoyable currency.” It’s money wanted to let protection swinging expenditures. Of numerous tenants get angry when trying to get their put back. When the certain types of write-offs, exceptions, and credit is advertised, the brand new estate otherwise believe may be susceptible to California’s AMT. Rating Schedule P (541) to find the level of income tax to go into online 26 to have trusts that have either resident otherwise low-resident trustees and beneficiaries.

Book 519 – Additional Matter

Thus there won’t be any withholding out of social protection or Medicare income tax from the spend you can get for those services. These types of services are very minimal and generally were only on-campus works, standard education, and you will economic hardship work. A shipping by the an excellent QIE to a great nonresident alien stockholder one try managed because the get in the selling otherwise change away from a You.S. real estate focus because of the shareholder are susceptible to withholding from the 21%. Withholding is even expected to the specific withdrawals or other transactions from the residential otherwise international firms, partnerships, trusts, and you may locations. While you are a nonresident alien performer or athlete undertaking otherwise doing sports events in the united states, you are able to get into a great CWA for the Irs for quicker withholding, given the requirements is actually fulfilled.

Particular foreign-origin funding money for example focus and you will investment gains is generally subject to income tax. For additional info on Paraguay’s business taxation, judge construction and you will income tax treaties, listed below are some incorporations.io/paraguay.This would never be construed while the tax advice. We have entry to a worldwide system out of licensed attorneys and accounting firms who’ll provide the best advice for your unique items. If you have no employee-employer dating ranging from you and the individual to own the person you perform characteristics, your settlement try subject to the newest 31% (otherwise all the way down treaty) speed out of withholding. A contract you arrive at on the Internal revenue service out of withholding of your own payment to possess independent private characteristics works well to own costs secure by agreement once it is agreed to from the the events. You ought to agree to prompt document a taxation go back to have the modern income tax 12 months.

Societal defense and Medicare fees are not withheld of buy it works except if the new alien is considered a resident alien. When you’re a nonresident alien briefly admitted to the United Says as the a student, you’re fundamentally not allowed to work with a wage or paycheck or perhaps to do business when you are regarding the United states. In some instances, students accepted on the You in the “F-step one,” “M-step one,” or “J-1” condition is actually granted consent to function.